blacklab14

New Member

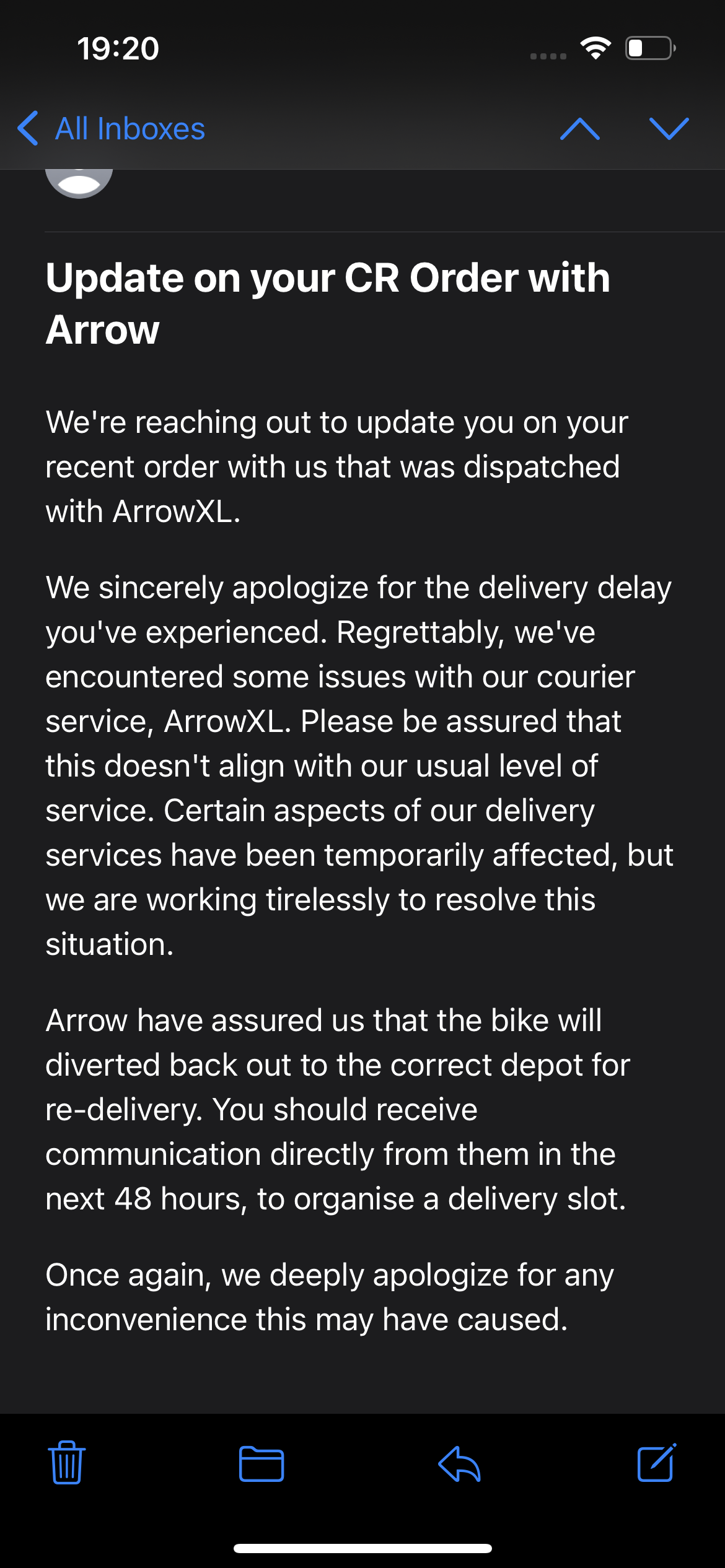

Anyone else get this?

Yep, though I requested ArrowXL to return it and CRC advised it was on the way back to them…! (As I’ve said I don’t want it anymore due to all the messing around and possibility of no warranty)

Wait, they really send haribo with orders? I have seen pictures here and there with haribo, I thought it was just that person being funny.Ordered a rim from Wiggle 12.50pm yesterday arrived 9.15am today paid no extra for postage or anythingplus haribo starmix inside which my son stole

No they really send them, iv been saving them up all year, got enough to do my 4 daughters and two grandsons xmas stockins with them nowWait, they really send haribo with orders? I have seen pictures here and there with haribo, I thought it was just that person being funny.

How the rise and fall of a billionaire property kingpin rocked Germany

Rene Benko’s wild ride at the helm of Signa has become another stain on Deutschland Inc

By Ben Marlow, ASSOCIATE EDITOR 10 November 2023 • 4:52pm

A little over two miles south-east of central Hamburg, where the mighty River Elbe and Oberhafen canal converge, stands the half-built concrete shell of what would have been one of Germany’s tallest skyscrapers.

At 800ft and 64 storeys high, and at an estimated construction cost of nearly €1bn (£870m), the Elbtower was approved in 2018 to remarkable fanfare.

Professor Jürgen Bruns-Berentelg, the man in charge of the redevelopment of the surrounding HafenCity district, declared that when completed, it would represent the “city’s future potential, its economic power, and its courage to shape the future”.

He was far from the only fan. The German Chancellor became such a big cheerleader of the project when he was mayor of Hamburg that it was nicknamed the “Olaf Scholz tower” in some quarters. Meanwhile, a testimonial on the Elbtower’s own website professes that tall buildings “often become a symbol of an economic upswing and optimism”.

Not this one. With construction work abruptly suspended, the Elbtower is destined to become a symbol of the worst excesses of the cheap-money property boom of the last decade. The Hamburg government has threatened to take control of the site if work does not resume soon. A planned branch of the jet-set sushi chain Nobu is firmly on ice.

The Elbtower is emblematic too of much that is rotten in Europe’s biggest economy, as the business empire of Rene Benko, the Austrian billionaire behind the scheme, threatens to spectacularly unravel.

With Benko’s holding company Signa unable to pay the wages of construction workers toiling away on the structure, as a property crunch unfolds across the Western world, a scramble has ensued among his key backers to prevent the Benko kingdom collapsing like a house of cards. The failure of an attempt to cash in the unfinished Elbtower was among the triggers for the crisis.

German Chancellor Olaf Scholz was a big supporter of the Elbtower project while serving as Hamburg mayor

One of Signa’s largest investors, Austrian construction tycoon Hans Peter Haselsteiner thinks the company can be rescued through an emergency capital injection. “It’s not overly indebted, rather in a difficult liquidity situation,” Haselsteiner told the Tiroler Tageszeitung newspaper. But all the shareholders need to take part in “otherwise it won’t work”, he said.

Others are less sure. “The big question everyone is asking and [Signa] needs to answer is what is the precise liquidity need and how quickly is it required? The rumour is it needs a lot super quickly. If you’re an investor or lender, how do you get comfortable with that given the lack of clarity?”, a restructuring adviser to one group of creditors says.

Benko’s efforts to maintain a low profile are at odds with the vast collection of prestigious buildings that he has assembled around the world.

In London, he commands a 50pc stake in the Selfridges department store. In Berlin he has scooped up illustrious retailer KaDeWe. In Vienna, Signa is the proud owner of the striking luxurious Park Hyatt Hotel, and in New York he owns half of one of the most recognisable skyscrapers in the world: Manhattan’s Art Deco Chrysler building.

“The Chrysler was a status thing. It was his international calling card, owning a piece of historic primary real estate in New York like that,” Marcus How, of Vienna-based investigative consultancy, says.

Rene Benko owns half of Manhattan’s world-famous Chrysler building

Benko’s woes threaten to be particularly uncomfortable for the German establishment. Though his business interests stretch around the globe, the early signs are that Germany could bear the brunt of any fallout such is the extent of Signa’s presence there.

That would heap yet more embarrassment and shame on a business elite still reeling from the collapse of technology poster-child Wirecard, repeated controversies at Deutsche Bank, and the elaborate “dieselgate” emissions fraud at Volkswagen. There was a time when Germany’s corporate titans were universally admired but Deutschland Inc. has more recently become a byword for costly scandal, excess and wretched governance.

Across Europe and America a shake-out of the multitrillion-pound commercial property industry is underway, brought about by a sharp reversal in interest rates, plummeting valuations and a scramble for cash among those that over-borrowed the most.

Benko is as exposed as anyone by virtue of the sheer size of his empire, his enthusiasm for tapping the credit markets and a collection of assets with valuations under pressure.

He reportedly likes to joke that only the Catholic Church and the British monarch are able to boast property portfolios to match Signa. Perhaps he’s only half-joking. Few individuals have created a property company of similar scale.

The number-one property mogul in America is Donald Bren, with real estate worth $18bn, according to Forbes. The people that manage the vast fortune of Europe’s richest person, fashion tycoon Amancio Ortega, say he has amassed property worth $20bn.

Though the complexity of the Signa estate, as well as plunging asset valuations, make a precise figure virtually impossible to arrive at, the Austrian outfit claimed last year to be sitting on bricks and mortar with a paper value approaching €30bn. Reports suggest it has a further €25bn of planned building projects. Many of those are underway, though a growing number are now lying idle as a result of the cash crunch that threatens to overwhelm Signa.

Benko’s extended shopping spree is a far cry from his unremarkable early life.

Born in Innsbruck in 1977, he grew up in a small apartment. His father was employed by the local council and his mother worked in a kindergarten. A first taste of the property trade came at school where he juggled lessons with a side-trade turning attics into living space. He skipped so many classes that he wasn’t allowed to stay on and finish the Austrian equivalent of his A-levels.

He was soon scouting around for financial help. With the backing of a millionaire friend of a penthouse he had converted, he eventually struck out alone. By 2003, Benko was looking for further investors with a promise on Signa’s website: “You can now earn money by doing nothing.”

His big break came in 2004 when the heir of an Austrian gasoline chain bankrolled Benko’s purchase of the venerable department store Kaufhaus Tyrol in his hometown. He was just 27 years old. Over the next decade, Benko hoovered up scores of so-called “prime” real estate, largely in German-speaking countries.

The takeover of Berlin’s department store KaDeWe in 2012 propelled Benko into the super league

But it was the takeover of Berlin’s department store KaDeWe in 2012 that propelled him into the super league. Considered one of the city’s most illustrious buildings, infighting among its then owners meant “nobody wanted to touch it”, Leonhard Dobusch, a professor of management at Innsbruck University, who has followed Benko’s career closely, says. Benko snapped up the property within weeks of it going on the market.

“You have this young, smart and charismatic guy who can tell a story that promises superior profits. He was able to buy a large building in Berlin that was considered to be unbuyable. But he did and suddenly he was someone who delivered. You have this initial miracle and then all that is needed is for rates to stay low and prices to rise,” Dobusch says.

Cracks in the Benko facade were already emerging, however.

The following year, he was convicted for bribery. An Austrian court found him guilty of trying to bribe Italian government officials to forgive a tax bill Signa was liable for in Milan. The conviction and suspended one-year jail sentence forced Benko to formally relinquish the day-to-day running of his company. At the same time, Benko was investigated for money laundering but the case was later dropped by the Vienna public prosecutor.

Yet, still he was able to charm a potent mixture of distinguished business figures, highly influential politicians, as well as the big banks, insurers and bond investors that would help finance his remarkable deal-making.

“Everyone was just strangely blind to it,” How says.

A list of Signa’s main investors read like a who’s who of the German and Austrian elite. Construction king Haselsteiner owns 15pc of the business. Transportation tycoon and Germany’s richest man Klaus-Michael Kuehne holds 10pc of the shares. Others include France’s billionaire Peugeot family, the late Formula One driver Niki Lauda’s foundation, and Tetra Pak’s Rausing dynasty. Early backers included the diamond dealer Benny Steinmetz, who has since been convicted of corruption in an unrelated matter.

High returns and generous dividends may have held their attention. “He was promising his investors a 6pc to 8pc return on their investments,” How says.

Meanwhile, Signa Prime, which houses the company’s high-end properties, paid out more than €630m in dividends between 2014 and 2021. Benko bought a $45m, 203ft superyacht, Roma, with accommodation for a dozen guests and 14 crew.

As Austrian chancellor, Sebastian Kurz was also among the many guests wined and dined at Benko’s Tyrollean-themed autumn parties

During his time as Austrian chancellor, Sebastian Kurz was also among the many guests wined and dined at Benko’s well-attended, Tyrollean-themed autumn parties, hosted at the grand Park Hyatt hotel in Vienna. Yet, the lavish gathering hasn’t been held since 2019 – around the same time that Europe’s financial watchdogs started asking serious questions about the sustainability of Signa’s business model.

That year, Austria’s Financial Market Authority expressed concerns about the exposure of the country’s second-largest bank Raiffeisen to the Signa group. The FMA calculated that the lender had breached “internal limits” by as much as nine times, according to an FMA message seen by Bloomberg. Raiffeisen challenged the calculations and no action was taken.

German regulator BaFin and the European Central Bank have also been quizzing the continent’s banks and big insurers about the extent of their lending to the company. A 76-page internal presentation seen by Reuters listed nearly 40 lenders and insurance companies as “investors and financing partners”. Though there is no date on the document, it contains data from 2019.

The intense scrutiny appears to have caused some of those that have funded Signa’s rise to pull back. In February, it emerged that Deutsche Bank, an organisation that has demonstrated a greater willingness than others to take on colourful characters such as one Donald J Trump as clients, had severed virtually all ties with Benko.

“To build up that much real estate in such a short period of time is only possible if you engage in risky lending and leveraging practices. And that’s what they did. What they have now is a liquidity crisis,” Dobusch says.

Questions have repeatedly asked about Signa’s opaque structure – a web of more than 100 companies held through trusts and shell companies based in Switzerland and Liechtenstein making it difficult to obtain a clear picture of its true financial state.

Concerns have also been raised about a set-up propped up by Benko’s tendency to become a prominent tenant in his own properties, which critics say has enabled valuations to keep increasing even as other big property investors have been forced to take sharp write-downs.

“The whole business model was based on being able to increase rents, so that they would be able to obtain ever higher valuations. That would then allow them to roll over their loans.”

Meanwhile, Benko continues his brushes with the law.

Earlier this year, he was acquitted in another bribery case, while Benko is currently a named suspect in a second, separate corruption probe by Austrian prosecutors, which resulted in Signa’s Innsbruck headquarters being raided in October. No charges have been made against Signa or Benko, and both have denied any wrongdoing in relation to the investigation. Former chancellor Kurz was implicated in the same investigation and has said that the “allegations are false.”

The man tasked with trying to make sense of it all after Benko agreed to hand over control is German insolvency expert Arndt Geiwitz. He must quickly identify what the short-term liquidity gap is, and then whether it can be bridged.

According to Signa’s annual report, a €200m bond issued by Signa Prime falls due at the end of November, and an investor profit participation scheme is due at the end of the year. A smaller unit, Signa Development, has a €250m construction loan maturing next year, according to Fitch.

Germany’s richest man Klaus-Michael Kuehne has rejected calls to finance the remaining construction of the Elbtower CREDIT: Feddersen/ullstein bild via Getty Images

But Signa’s ability to repay its loans is in question. In 2022, Signa Prime swung from a €700m profit the previous year to losses of more than €1bn. Borrowings totalled €10.8bn. Earlier this month, Signa’s sports retail arm, listed in New York, filed for insolvency.

Benko is at the mercy of lenders and existing investors. But as one restructuring specialist points out: “If you’re an investor, putting new money in is a throw of the dice. You would want lenders to give new terms or you could be back around the table within a few months. Will people get comfortable? That’s the big question.”

There are already signs that shareholders are reticent about participating in any cash call. Consulting king Roland Berger, who is also on the Signa board, told German newspaper Handelsblatt last month that he’s exercised a put option to sell back his 1.6pc stake in Signa Prime, while Klaus-Michael Kuehne has rejected calls to step in and finance the remaining construction of the Elbtower.

“Signa needs calm and order at this time. We will approach these important tasks prudently and rationally,” said Geiwitz following his appointment last week.

Benko could only lament: “Given the current situation, this is the best solution for the company as well as its partners, investors and employees.”

The stakes are high, especially for Germany, which Benko built into Signa’s most important market with projects spread across cities like Berlin, Hamburg, Düsseldorf, Stuttgart, Munich and Frankfurt.

Yet, many of those have downed tools at a time when one in five of the country’s property companies said they have cancelled building projects, according to a survey by the IFO institute in Munich in September.

“The beautiful thing is that everybody, or most, wants something from me,” Benko told Austrian public TV in 2019. That may turn out to be true – just not in the way he intended.

Additional reporting by Luke Barr.

One thing is for sure, he’ll be just fine at the end of all this at the centre of his billion $ empire, the people working at the edges of his shrinking portfolio of companies maybe not so much.This article about Benko, owner of Signa, is in yesterdays UK Telegraph. Behind a paywall I think, so quoted in full.

How the rise and fall of a billionaire property kingpin rocked Germany

Rene Benko’s wild ride at the helm of Signa has become another stain on Deutschland Incwww.telegraph.co.uk

Walid Chammah files lawsuit against Signa for unpaid €14m advisory fees

Sounds legit...The dispute centers around an agreement reportedly made in a Mayfair private members club in 2015.

Does seem to be consistent with the way Benko frequently conducted his wheeling dealing ..Sounds legit...

Anyone ordered from bikester lately?

www.cyclingweekly.com

www.cyclingweekly.com

/cloudfront-us-east-2.images.arcpublishing.com/reuters/JF2VLMWOD5P2NOA6M3EY3OHMQQ.jpg)

Interesting.Wiggle stopping international shipments

WiggleCRC closes international shops to 'solely focus' on the UK as it searches for buyer

Administrators cite economic impact of Brexit as retailer cuts trade overseaswww.cyclingweekly.com

www.cyclingweekly.com

www.cyclingweekly.com

Interesting.

I recently bought my first (and now I’m assuming last) Nukeproof products from CRC. Since they entered administration.

I’ve received all packages now. The first delivery was very well executed. The 2nd and 3rd were from a different delivery company and were a little comical. Twice, they told me my packages were being sent back to the UK after making it to Canada, when in fact they were getting closer to my house after having landed here.

Kind of sad. I was impressed with the quality and price of the Nukeproof products we received. Oh well, glad I had jumped on a few items I wanted!

www.forbes.com

www.forbes.com

UK Daily Telegraph said:Why Rene Benko’s fall threatens to bring down Germany’s elite

Collapse of Selfridges tycoon's empire comes at worst possible time for Europe’s largest economy

Ben Marlow, Telegraph, February 3, 2024

Perhaps it was the cold wind that barrelled down Oxford Street, or the early hour, but on Thursday morning there was little sign of life behind the heavy revolving doors of Selfridges’ grand entrance.

Staff seemed to outnumber customers by about 20 to one. Amid the sea of perfume counters that stretch across the ground floor, employees gazed out hopefully, or buried their heads in mobile phones. A man behind the information desk appeared to have succumbed to boredom already as he let out a huge yawn.

If only life in the boardroom was this uneventful. A retailer that spent 15 years under the warm embrace of Canada’s Weston family has been swept up in the chaos that has engulfed the business empire of Austrian billionaire Rene Benko after its spectacular collapse. Selfridges was sold to Benko’s Signa Holding and Thailand’s Central Group in 2022 for £4bn.

It means one of Britain’s most illustrious retailers faces the ignominy of its future ownership being determined nearly 800 miles away in a Vienna insolvency court as Benko’s stake is put on the block as part of a desperate cash-raising exercise.

Yet, it is nothing compared to the shame that Benko’s downfall threatens to heap on Germany’s political and business elites. His property empire Signa Holding was one of the world’s largest and most eye-catching, with trophy assets dotted across the Continent and beyond.

Benko’s property empire included ownership of half of New York’s Chrysler Building.

Benko owned half of New York’s Chrysler Building and the historic five-star Bauer Hotel on Venice’s Grand Canal. Investors include France’s Peugeot family, Arab states, and Japan’s SoftBank.

Austrian high society had a ringside seat during Benko’s astonishing rise. He courted the great and good of his homeland. Among those he forged close relationships with were two former Austrian chancellors Sebastian Kurz and Alfred Gusenbauer, but there were many more former MPs, top civil servants and municipal officials.

Perhaps because of a common language, nowhere welcomed Benko outside of Austria like Germany. Its financial institutions bankrolled his extraordinary empire-building with great enthusiasm, leaving the provincial landesbanks as some of his biggest creditors.

Insurance giants Allianz and Munich reportedly lent a combined €3bn (£2.6bn) to Signa, a third of which was not backed by any collateral. Many of the country’s top businessmen including Germany’s richest man Klaus-Michael Kuehne were among his largest shareholders.

As Hamburg mayor, Olaf Scholz was a vocal supporter of Signa’s Elbtower project.

He was even championed by German Chancellor Olaf Scholz, who as mayor of Hamburg was a vocal champion of Benko’s efforts to erect several landmark buildings in the city including the Elbtower on the banks of the river Elbe. Scholz called the project, due to be completed in 2025, “a signal of Hamburg’s ambition”.

For the eurozone’s largest economy, the fallout comes at the worst possible time. ING economist Carsten Brzeski has described Germany as being in “permanent crisis mode”. An over-reliance on Russian oil and gas and Chinese demand has left an industrial powerhouse standing on the brink of a recession.

The manufacturing and construction sectors have contracted sharply, and now a spiralling property crunch triggered by rising interest rates and escalating building costs is set to be exacerbated by the sheer scale of Signa’s presence as Germany quickly became one of its largest markets.

Construction at six sites – three in Hamburg and three in Berlin – stopped in November, according to the analytics firm Bulwiengesa, raising serious questions about others in Dusseldorf, Munich, Frankfurt, Stuttgart, Wolfsburg, and Dresden.

Germany’s most prestigious department store KaDeWe filed for administration last Monday, declaring it could no longer afford to pay escalating rents imposed by Signa.

In a country where high profile corporate scandals such as VW’s emissions fixing and the giant accounting fraud uncovered at tech darling Wirecard are still fresh in Germany’s collective memory, the unravelling of such a prominent property developer promises some fresh soul-searching.

Berlin department store KaDeWe filed for administration after declaring it could no longer afford to pay Signa’s rents.

The insolvency process is unlikely to provide much respite having already descended into chaos. With each of the different parts of the Signa empire appointing their own administrator, shareholders and creditors from the respective parts have been pitted against each other in an insolvency battle royale, with everyone trying to protect their own assets and interests.

The words of the man tasked with overseeing what is shaping up to be one of the biggest and most complicated corporate meltdowns Europe has ever seen offer little hope for those chasing Benko’s companies for repayment.

“Coordination with the other insolvency administrators was not possible despite considerable efforts by the holding’s insolvency administrator, due to the differing interests involved,” Christof Stapf, the insolvency lawyer now in control of Signa, warned in a statement.

The early signs are that many, if not most, could walk away empty-handed. Many of the important numbers are a long way from tallying up. Signa announced debts of around €5bn when a cash crunch toppled it last year.

Yet claims totalling €8.6bn have been received and Stapf says that he recognises just €80.3m of those tabled with many of the claims arriving either without necessary supporting materials or late.

Meanwhile, when long-overdue accounts were filed for one of Signa’s largest subsidiaries, they showed just €32m of assets that could easily be converted into cash. It has also emerged that one of the group’s companies transferred more than €300m to two entities controlled by Benko’s family, according to reports.

Sheer complexity is another issue. A chart of the group’s labyrinthine structure runs to 46 pages of A3 paper and Signa comprises more than 1,000 corporate entities, Stapf explained recently.

The experience of Swiss wealth manager Julius Baer provides a glimpse of what may await those that allowed themselves to be sucked into Benko’s dizzying orbit. On Thursday, the private bank unveiled a 52pc fall in profits and a SFr606m (€650m) write down on its exposure to Signa. But it didn’t stop there. Chief executive Philipp Rickenbacher stepped down after five years in charge.

He is unlikely to be the last casualty of an extraordinary saga that in many ways is only just beginning.

www.cyclingnews.com

www.cyclingnews.com

singletrackworld.com

singletrackworld.com

The new buyer "doesn't want the staff!" They may have no choice in the matter!

'Once the warehouse is clear, it's game over' – WiggleCRC lays off almost entire workforce

'The new buyer apparently doesn't want anyone' says anonymous sourcewww.cyclingnews.com

The second story want there when I started to reply. According to the timings, it still wasn't there when I posted.I guess you didn't read the second story...

Looks like that's that then. Ashley owns a multi channel distribution system, has a long history of hoovering up brands & putting them through it. My guess is he'll bin the warehouse in Bilston, sub out all the manufacturing that isn't already & shovel everything through Shirebrook out to Evans & Spots Direct. He can't lose.

Wiggle Chain Reaction Deal Falls Through: Mike Ashley Buys Name and IP

tMass laying off of staff across the company. Company will live on in name only, with the brands & IP being bought by Mike Ashleysingletrackworld.com

The World's largest electric mountain bike community.